Menú

TODOS LOS PRODUCTOS

DESTACADOS

EN EXCLUSIVA

DESTACADOS

POR TIEMPO LIMITADO

TODOS TUS PRIVILEGIOS

DESCUBRE

PARA EL DÍA A DÍA

PARA INVERTIR Y AHORRAR

GESTIONA TU NEGOCIO

PARA EL DÍA A DÍA

PARA CRECER

PARA INVERTIR Y AHORRAR

Menú

TODOS LOS PRODUCTOS

DESTACADOS

EN EXCLUSIVA

DESTACADOS

POR TIEMPO LIMITADO

TODOS TUS PRIVILEGIOS

DESCUBRE

PARA EL DÍA A DÍA

PARA INVERTIR Y AHORRAR

GESTIONA TU NEGOCIO

PARA EL DÍA A DÍA

PARA CRECER

PARA INVERTIR Y AHORRAR

Este número es indicativo del riesgo del producto, siendo 1/6 indicativo de menor riesgo y 6/6 de mayor riesgo.

Unicaja Banco, S.A. está adherida al fondo de garantía de depósitos de entidades de crédito, creado por el real decreto-ley 16/2011, de 14 de octubre, cuya cobertura tiene un importe máximo de 100.000 € (o, en los casos de depósitos no nominados en euros, su equivalente en la divisa de que se trate) por depositante y entidad de crédito.

Indicador relativo a la cuenta

Nueva Cuenta Online Remunerada

¡Hasta 600 € extra¹!

Y obtén hasta 100 € de reembolso por tus recibos

¡Sólo para nuevos clientes online!

(1) Ejemplo representativo: 2,018% TAE en el supuesto de un saldo medio mensual de 30.000 € al 2,00% TIN. Los intereses brutos ascienden a 50€/mes con liquidación mensual. Sin comisión de mantenimiento ni administración.

Tenemos la hipoteca que se adapta a tus necesidades. Usa nuestro simulador de hipoteca y calcula tu cuota sin compromiso.

Además, con tu hipoteca te llevas un 5 % de descuento en IKEA y el asesoramiento gratuito de un Diseñador de Interiores. Sólo hasta el 30 de septiembre de 2024.

Y tienes menos de 35 años, consigue tu Hipoteca Joven con hasta el 97,5 % del valor de tasación o compraventa, el menor de los dos.

Concesión sujeta a criterios de la entidad.

Con nuestro préstamo tienes hasta 60.000 € para financiar tu vehículo nuevo o de segunda mano a un interés fijo.

Destapamos el potencial de base que llevamos dentro

Cambiamos nuestra Identidad Corporativa.

Otro pequeño-gran paso, para que tú puedas seguir descubriendo tu propio mundo de opciones.

Los nuevos clientes que adquieran online la Cuenta y Tarjeta de Débito PlayStation®, obtendrán 25 € de crédito PSN al realizar un gasto mínimo de 20 € con su Tarjeta PlayStation®.

Consigue la nueva Tarjeta de Débito Real Madrid sin comisiones para nuevos clientes online.

Sin comisión de emisión ni mantenimiento para nuevas contrataciones online hasta 30/06/2024.

Siempre cerca de ti

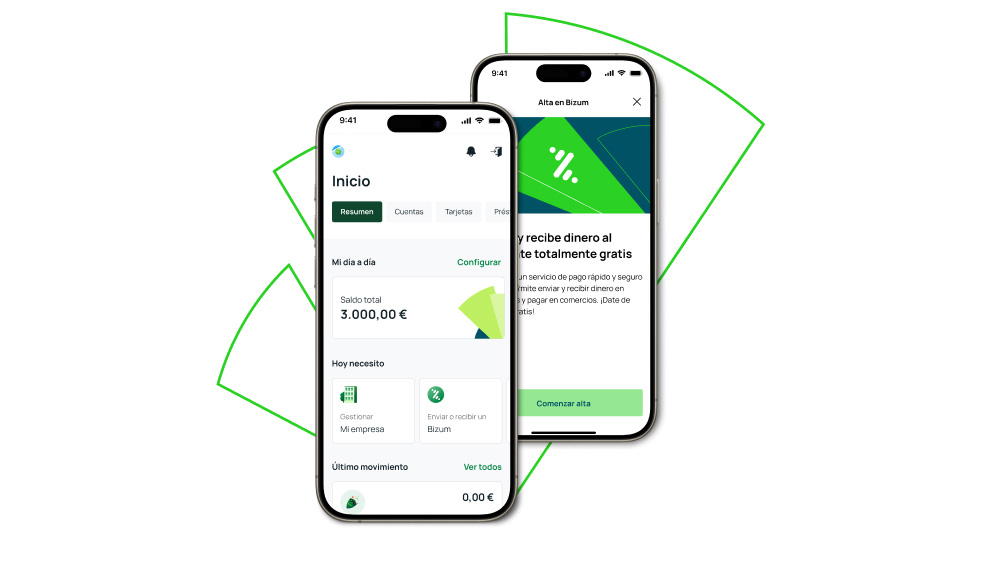

Descarga nuestra app de Banca Digital

Descubre la app de Unicaja y disfruta de una experiencia rápida, segura y cómoda.

¡Controla tus cuentas, realiza transferencias y accede a múltiples servicios desde donde estés!

¡No esperes más! Descarga la app de Unicaja ahora y lleva el banco contigo a todas partes.

¿Vas a una de nuestras oficinas? Pide cita previa

Recuerda que puedes pedir cita para evitarte colas y acudir cómodamente a cualquiera de nuestras oficinas.

Departamento de Atención al Cliente

En Unicaja ponemos a tu disposición el Departamento de Atención al Cliente por si deseas interponer una queja o reclamación formal sobre cualquiera de nuestros servicios.

¿Te ayudamos?

También en el 952 076 263 o a través del formulario de contacto.

Nuestro horario de atención telefónica es de lunes a sábado de 8:00 a 22:00 (excepto festivos nacionales).

También ponemos a tu disposición otras vías de contacto: