Menu

ALL PRODUCTS

OUTSTANDING EXCLUSIVE

OUTSTANDING EXCLUSIVE

LIMITED TIME OFFER

ALL YOUR PRIVILEGES

DISCOVER

FOR DAY-TO-DAY NEEDS

TO INVEST AND SAVE

MANAGE YOUR BUSINESS

FOR DAY-TO-DAY NEEDS

TO GROW

TO INVEST AND SAVE

Your online mortgage from home

No need to move. Everything can be done from your sofa, except to go at the notary's office, where we'll finally see each other.

Fixed or Variable Rate

You choose whether you want to pay the same each month or make repayments depending on the Euribor rate.

With a specialised manager

You'll have a manger to accompany you throughout the process. You can also enquire about your application's status at any time.

And what if I prefer going to a branch?

If you wouldn't like to do it all on the Internet, you can also personally go to a branch to apply for this mortgage.

Terms and conditions of the Fixed-Rate Youth Mortgage

With bonus¹

APR in first half-year 3.75 %,

subsequently 3.65 %

AER 4.48 %

Front-end fee: 0.15%

Without bonus²

APR in first half-year 3.75 %,

subsequently 4.65 %

AER 4.81 %

Front-end fee: 0.15%

Terms and conditions of the Variable-Rate Youth Mortgage

With bonus³

APR in first year 2.70 %, subsequently Euribor+0.75 %

Variable AER 5.13 %

Front-end fee: 0.15%

Without bonus⁴

APR in first year 2.70 %, subsequently Euribor+1.75 %

Variable AER 5.43 %

Front-end fee: 0.15%

Up to 30 years to repay your mortgage

You can repay it in up to a maximum of 30 years and in up to 25 years for a second home.

Financing of up to 80%

You will be able to finance up to 80% of your main residence and up to 70% of a second home with the 100% Online Youth Mortgage. The amount to be financed will be the lower of the purchase price and the valuation.

Get better financing through the regional authorities' housing programmes for young people up to 35 years of age.

Practical information mortgages

Mortgage loan access guide

Aquí tienes la información que necesitas para contratar un préstamo dirigido a la adquisición de una vivienda.

Code of good practice

Here you have access to general information on measures to strengthen the protection of mortgagors

How does the 100% Online Youth Mortgage work?

If you wish to apply for a personalised 100% Online Youth Mortgage, you just have to follow the four steps below. Although it's very easy, we will however guide you throughout the process and provide you with information on your mortgage application's status.

SIMULATION

Once you are in the simulator, calculate the monthly repayment for the type of mortgage (fixed or variable-rate) that meets your needs.

ASSESSMENT

Submit the documents needed to conduct an assessment of your Youth Mortgage.

APPROVAL

Once the documents have been assessed and they are in order, your Youth Mortgage will be approved so you can read and sign the legal documents electronically.

SIGNING

Only signing at the notary's office now needs to be done. Choose the notary's office you prefer and we will send you all the documents there. It's as simple as that to enjoy your new home!

The Youth Mortgage offers better terms and conditions to make it easier for people under the age of 35 to gain access to financing at such an important moment of their lives. If you want further information, request it through our form.

The main requirement is that none of the mortgagors can be older than 35 years of age.

In addition, it is a mortgage solely meant for the purchase of a home by natural persons residing in Spain who have income or wealth in euros. It is necessary to subscribe a current account at Unicaja, as well as an indemnity insurance policy that covers any possible contingencies the home may suffer. Granting is subject to the institution's criteria after having conducted a risk viability study.

Not necessarily, though it will always be conditional on the risk study the branch will conduct. This study assesses the ability to pay; in other words, the continuity and stability of the income of the Youth Mortgage's mortgagors, along with any other debts they may have.

Change data in the form

If there are any errors in the data you have entered or you need to make changes to them, you can cancel the application and initiate a new one. When the manager gets in touch with you to process your application, you can also inform them about which data you wish to change and we will do it for you.

CHECK OUT THE FOLLOWING TYPICAL EXAMPLES

Typical examples

AER, total cost of the mortgage loan and total amount owed by the borrower based on a typical example of a loan amounting to €150,000 with a front-end fee of 0.15%, a 25-year repayment term through the payment of 300 constant monthly repayments, including both the principal and interest, and with the interest rate indicated below:

25-YEAR FIXED-RATE MORTGAGE:

(1) Meeting all the requirements to obtain maximum interest rate bonus:

Salary deposited directly into account as from €600 net per month. Debit or credit card consumption for an amount of at least €1,200.00 calculated in the 6 months prior to the date of the annual interest rate bonus review and subsequently during the 12 months prior to the date of each interest rate bonus review. Three directly debited basic bills. Protection Home Insurance. Life insurance associated to the loan. Minimum contribution to a pension plan of 1.2% of the outstanding principal in the 6 months prior to the date of annual interest rate bonus review and subsequently during the 12 months prior to the date of each interest rate bonus review.

The fulfilment of requirements will be checked as of the second half-year of the loan's term and thereafter at successive annual reviews.

(2) Without meeting the requirements (interest rate without bonus):

25-YEAR VARIABLE INTEREST RATE YOUTH MORTGAGE:

(3) Meeting all the requirements to obtain maximum interest rate bonus:

This APR can be obtained with other combinations of subscribed products/services other than those used by Unicaja to calculate the example.

Salary deposited directly into account as from € 600 net per month. Debit or credit card consumption for an amount of at least € 1,200.00 calculated during the 12 months prior to the date of the annual interest rate bonus review. Three directly debited bills. Protection Home Insurance. Life insurance associated to the loan. Minimum contribution to a pension plan of 1.2% of the outstanding principal in the 12 months prior to each annual interest rate bonus review date.

The fulfilment of requirements will be checked as of the first year of the loan's term and thereafter at successive annual reviews.

(4) Without meeting the requirements (interest rate without bonus):

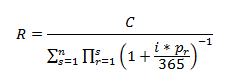

Repayment amount calculation formula for the previous examples (1), (2), (3) and (4): The repayments will include the principal and interest, and will be of a constant amount until an interest rate change or review.

In order to calculate the aforementioned repayments, the French amortisation method has been used, which is a constant-repayment amortisation system in which a larger amount of interest than the principal is paid off during the first years and more principal than interest is paid off in the latter years. The formula to calculate the amount of the repayments is as follows:

The values which appear in the formula have the following meanings:

"R": monthly repayment.

"C": the loan's nominal amount or principal (in the case of not meeting requirements, it will be the outstanding principal to be paid off at any given time).

"n": the number of repayments. As from the interest rate review, they would be calculated for the outstanding part.

"r": index of the product (∏).

"s": index of the sum (∑).

"pr": days of interest accrual in the interest settlement period for which the repayment is calculated (can take on the values of 28, 29, 30 or 31 depending on the month).

"i": nominal annual percentage rate that applies to the interest period in question, expressed as a percentage.

The applicable formula to calculate this loan's interest is as follows: Outstanding principal multiplied by the APR (in percentage terms) and time, divided by 365. In this formula, it is construed that the principal is the balance of the principal, APR is the nominal annual percentage rate, and time is construed to be the number of calendar days depending on the month which is being calculated (28, 29, 30 or 31).

The amortisation of the principal will be equivalent to the repayment minus the interest.

(5) The AER indicated was calculated on March 5, 2024 using the APR and costs indicated that are charged to the customer, considering that no early repayments, either partial or full, are made throughout the entire term of the loan. Monthly principal and interest repayments. Due to the fact that the account is subject to fixed maintenance fees and, where appropriate, the debit card, the AER may vary according to the amount and term granted. The holders' age plus the loan's term may not exceed 75 years for a main residence or 70 years for a second residence. In the event of early repayment or redemption, either partial or full, of the loan during the first ten years of the loan agreement's term or from the day on which the fixed interest rate applies, a compensation in favour of the lender may be set, which may not exceed the amount of the financial loss the borrower may suffer, with a limit of 2% of the principal repaid early.

In the event of early repayment or redemption, either partial or full, of the loan from the end of the aforementioned period until the end of the loan's term, a compensation in favour of the lender has been set, which may not exceed the amount of the financial loss the borrower may suffer, with a limit of 1.5% of the principal repaid early.

(6) The Variable AER indicated was calculated on April 4, 2024 using the APR and costs indicated that are charged to the customer, considering that no early repayments, either partial or full, are made throughout the entire term of the loan and assuming that the reference rate does not vary. It will therefore vary with the interest rate reviews. Monthly principal and interest repayments. Due to the fact that the account is subject to fixed maintenance fees and, where appropriate, the debit card, the variable AER may vary according to the amount and term granted. The holders' age plus the loan's term may not exceed 75 years for a main residence or 70 years for a second residence.

In the event of early repayment or redemption, either partial or full, of the loan during the first three years of the loan agreement's term, a compensation or fee in favour of the lender may be set, which may not exceed the amount of the financial loss the borrower may suffer, with a limit of 0.25% of the principal repaid early, however, until December 31, 2024, no compensation or commissions will accrue for reimbursement or total and partial early repayment.

(7) Annual premium of Protection Home Insurance calculated for a flat having a floor area of 90 m2 without any contents, an insured building amount of €72,000.00, annual premium of the life insurance policy associated to the loan calculated for a person of 30 years of age. These insurance policies can be taken out with the insurance company chosen by the customer. Nonetheless, both kinds of insurance must be taken out with the intermediation of Unicaja to be able to take advantages of a bonified interest rate while meeting requirements. The insurance premiums will be updated annually in accordance with the specific terms and conditions of the policy.

(8) Annual premium of indemnity insurance (fire and third-party liability insurance) calculated for a flat having a floor are of 90 m2 without any contents and an insured building amount of €72,000.00. This insurance may be taken out with the company of your choice.

The borrower will be liable to Unicaja Banco, S.A. for the loan's repayment, not only with their home but also with all their current and future assets. You may lose your home if you fail to make your repayments promptly. Should a guarantor(s) be involved in the loan, the guarantor(s) will also be liable with all their present and future assets.

(*) Granting of our mortgages is subject to the institution's criteria. Mortgage for home purchases for natural persons who reside in Spain having income or wealth solely in euros.

(**) Insurance taken out with Unicorp Vida (life, risk or accident insurance), Caser (car, health, dental, home, payment protection or pet insurance) and/or Santalucía (funeral insurance) through Unimediación, S.L.U., a related banking-insurance operator, duly registered at the Special Administrative Registry of Insurance Brokers kept by the Directorate-General of Insurance and Pension Funds (Registration No. OV-0010), acting through the Unicaja Banco, S.A. network. Third-party liability insurance taken out according to prevailing legislation. You can query the insurance companies Unimediación, S.L.U. has entered into agency agreements with at www.unicajabanco.es/seguros.

INFORMATIVE NOTE FOR THE IDEP ON MORTGAGE LOANS ON A HOME TO BE FORMALISED OR THAT ARE ENTERED INTO IN ANDALUCIA

The consumer and user who wishes to take out a mortgage loan on a home has the right to be provided with an index of mandatory delivery documents, which lists all the documents that have to be provided until the loan contract is duly signed.

Law 3/2016, published in the BOJA (Official Gazette of the Government of Andalusia) of June 9 2016, for the protection of the rights of consumers and users when taking out loans and mortgages on housing.

Can we help you?

Also at 952 076 263 or through the contact form.

Our telephone service hours are Monday to Saturday from 8:00 a.m. to 10:00 p.m. (except national holidays).