(*) "New customer" is construed to mean any legal or natural person who has registered with the institution during the current year.

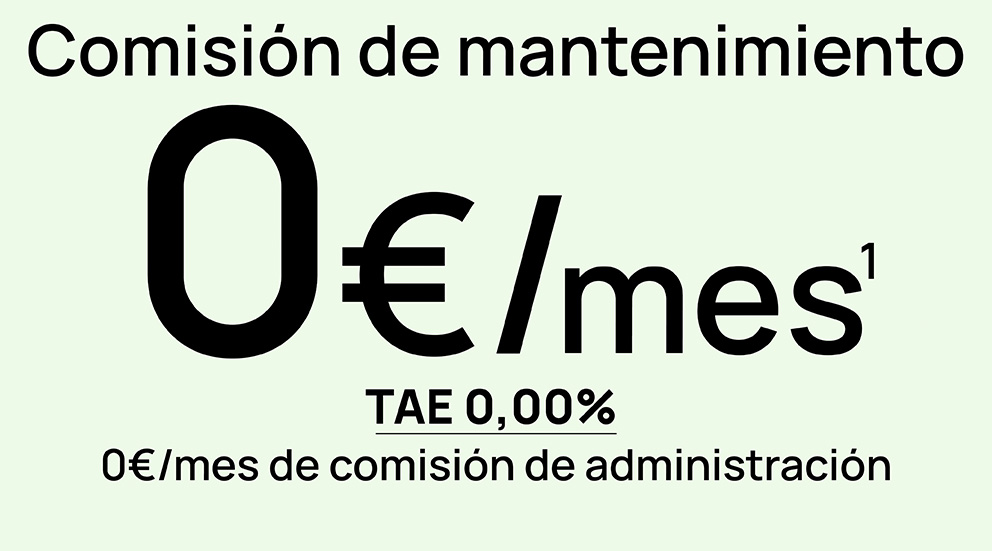

(1) AER of 0.00% calculated for an account having a constant average balance of €20,000 over a year at an APR of 0.00% and assuming that the association maximum requirements set out above have been met; in other words, account maintenance and administration fees of €0.00 a month. Without interest.

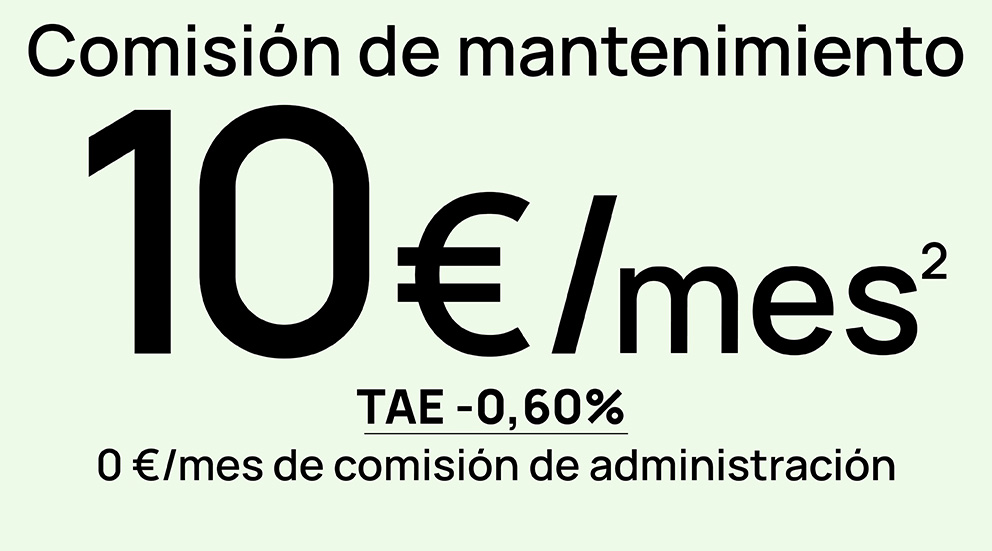

(2) AER of -0.60% calculated for an account having a constant average balance of €20,000 over a year at an APR of 0.00% and assuming that the association requirements set out above have been met; in other words, account administration fees of €0.00 a month and account maintenance fees of €10.00 a month. Without interest. In the case described above, the AER would vary depending on the balance in the account.

(3) AER of -1.34% calculated for an account having a constant average balance of €20,000 over a year at an APR of 0.00% and assuming that the association requirements have been met; representative example: account administration fees of €2.40 a month and account maintenance fees of €20.00 a month. Without interest. In the case described above, the AER would vary depending on the balance in the account.

(4) The exemption will apply to the business credit cards associated to the company account.

(5) For issuing euro-denominated transfers through Digital Banking (Unicaja website or app) or ATMs between customer payment accounts in the SEPA, including immediate transfers (fund movement orders, also known as FMOs, made through the Bank of Spain are excluded).

(6) The exemption will apply to the POS terminals associated to the business contract set out in the subscription document or to the one which replaces it.