This number is indicative of the risk of the product, with 1/6 indicating low risk and 6/6 high risk.

Unicaja Banco, S.A. is a member of the Deposit Guarantee Fund for Credit Institutions created by Royal Decree-Law 16/2011, of 14 October, covering a maximum amount of €100,000 (or, in the case of deposits not denominated in euros, the equivalent in the relevant currency) per depositor and credit institution.

Risk score related to the account

Quarterly interest payments

3% AER1 in the first year if you have your salary paid directly into your account. Maximum average balance to be paid is €20,000. From the second year, 0% AER.

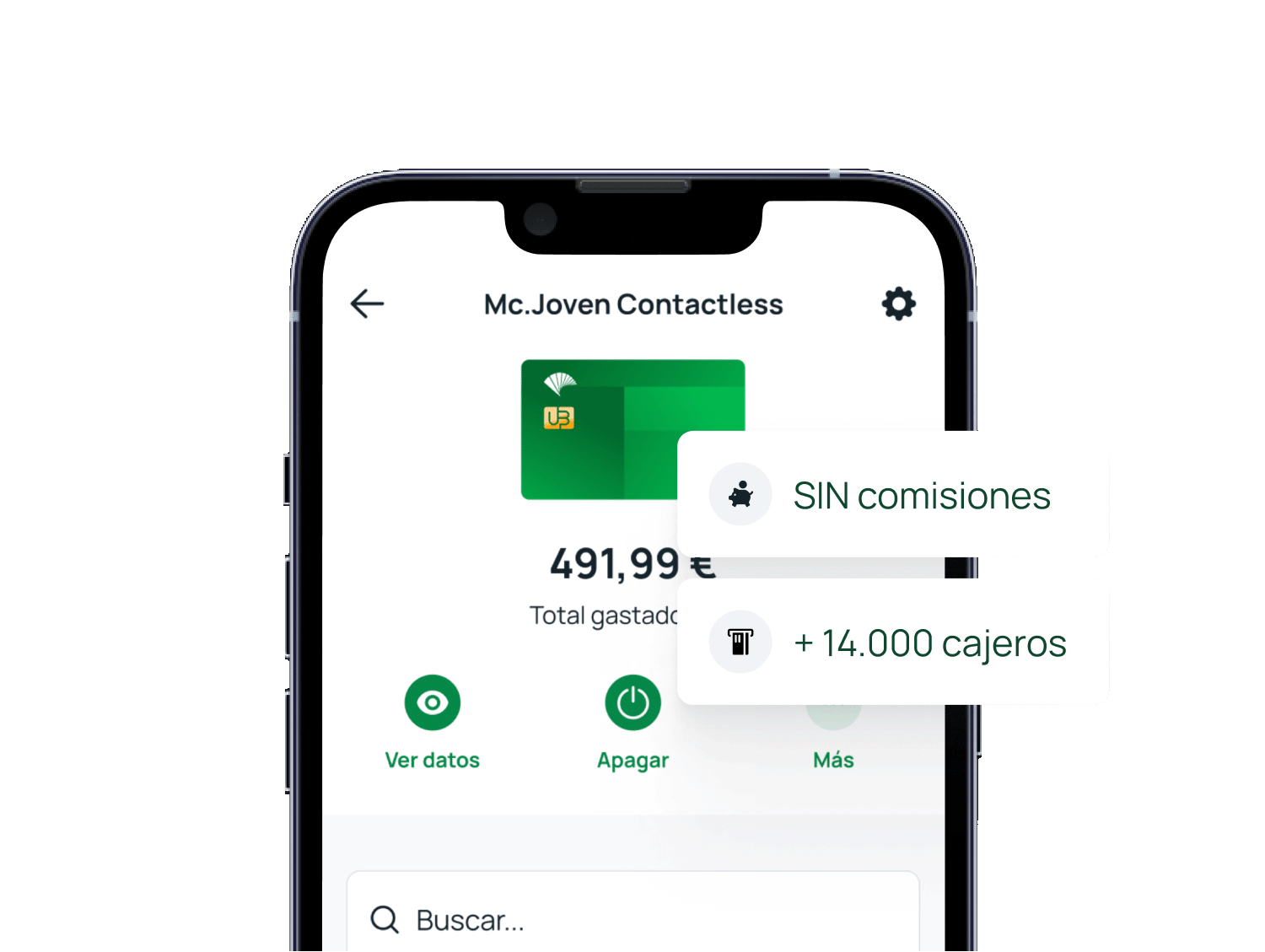

No fees

This account has no maintenance or administration fees, not even for making transfers².

Cashback on your bills³

Get up to €100 a year. If you get your salary directly deposited into your account, we reimburse you 1% of your main bills (water, gas, electricity and telecommunications).

Only for new customers

This offer is only valid for new online customers. Join Unicaja and enjoy more exclusive benefits!

Fully online application

Opening the Unicaja Online Account is very easy and can only be done online in six steps that will take you just a few minutes. Join Unicaja and enjoy more exclusive benefits!

Informative documents Online Account

You must be over 18 years of age, reside in Spain and be a new customer to subscribe this account. Any natural person who has not had any Unicaja Banco service and/or product in the last 12 months will be deemed a "new customer".

This account is solely for the use of individuals and you must confirm this is the case. If you are self-employed, you may not use it for your professional affairs.

If you directly debit your main bills (water, gas, electricity or telecommunications) to the Online Account, you will obtain a 1% cashback of their amounts. These reimbursements will be paid into your account and can add up to at most €100 a year.

In order to be able to verify you are really you without requiring you to go to a branch, we perform a video identification process.

You just need to ensure that the device you are using to perform your Online account's subscription is equipped with a camera.

During the video identification phase you must show:

- The front and back of your identity document.

- To complete the process, we will record a video and take a selfie of you.

Online Account Terms and Conditions:

(1) Special conditions for new customers. This offer is available to individuals who have not acquired any form of Unicaja product or service in the last 12 months. Only one account is allowed per customer. Typical example: If you get your salary or pension paid directly into your account (at least €600 per month) during the first year, and you maintain an average balance of €20,000, you will receive a gross annual amount of €593.40, based on 3.00% AER (2.967% APR). During this period, you will not be able to benefit from any other salary or pension promotions. During the first year, the return will be 0.00% AER (0.00% APR). Interest is paid every three months. No maintenance or administration fees. Offer valid until March 3, 2026.

(2) Exemption from transfer fees for standard and immediate euro-denominated transfers between payment accounts of customers located in the SEPA made on the Unicaja Electronic Banking service, Mobile Banking service or its ATM network. Fund Movement Orders (FMOs) made through the Bank of Spain are excluded from this exemption.

(3) Bonus for direct debits charged to the account. Unicaja will grant bonuses on water, electricity, telecommunications and gas bills, provided the direct debits charged to this account are not returned. This bonus will consist of an amount that will be the result of applying 1.00% to the sum of the directly debited amounts charged to the account in each interest settlement period of said account. This amount, on a quarterly basis, will be paid into that account on the Saturday immediately following the interest settlement date. The maximum annual bonus will amount to one hundred (100) euros. Hence, under no circumstances may successive payments of this bonus exceed €100 per year. If any of the directly debited bills is returned after the bonus is paid, Unicaja will be entitled to charge the proportional part of the bonus amount corresponding to any returned directly debited bills to the account or to any other account the CUSTOMER holds at this institution, even where they hold it jointly and severally with other holders. Bonus may not be accumulated with other similar promotions.

Interest received and bonuses for directly debited bills are subject to taxation and deemed for tax purposes as income from moveable capital obtained from the transfer to third parties of one's own capital according to Article 25(2) of Act 35/2006 on Income Tax. They are subject to a tax withholding at the current withholding rate pursuant to Articles 74(1) and 75(1) of the Personal Income Tax Regulation.

(4) Debit card without any issuance or maintenance fees. Debit cash withdrawals without any fees for using the card at ATMs belonging to the following networks at these provinces:

- At all Unicaja ATMs in: Cádiz, Málaga, Almería, Jaén, Ciudad Real, Albacete, Cuenca, Toledo, Cáceres, Salamanca, Ávila, Zamora, Valladolid, Soria, Palencia, León, Asturias, Cantabria, Ceuta and Melilla.

- At all Unicaja ATMs and additionally withdrawals as from €120 at any ATMs belonging to the EURO 6000 network, Banco Sabadell, Bankinter, Caja de Ingenieros, Arquia Banca and Euronet in the following provinces: La Coruña, Lugo, Orense, Vizcaya, Guipúzcoa, Álava, Navarra, Burgos, La Rioja, Huesca, Lleida, Girona, Barcelona, Zaragoza, Segovia, Madrid, Guadalajara, Teruel, Tarragona, Castellón de la Plana, Baleares, Valencia, Alicante, Murcia, Granada, Córdoba, Badajoz, Santa Cruz de Tenerife and Las Palmas.

- At all Unicaja ATMs and additionally withdrawals as from €120 at any ATMs belonging to any network in: Huelva and Seville.

Valid until 31 December 2026. The fee will always be displayed prior to the cash withdrawal so you can either accept or cancel the transaction. Three debit cash withdrawals per card and month without any minimum amount with Young Debit cards. EURO 6000 institutions include: Abanca, Novo Banco, Ibercaja, Kutxabank, Cajasur, Evo Banco, Cecabank, Caja de Ontinyent, Colonya Caixa Pollensa and Cardtronics.

- Terms and conditions for cash withdrawals from other domestic, Euro Zone, Swedish and Romanian networks: 100% of whatever the owner of the ATM charges Unicaja Banco for the withdrawal.

- Terms and conditions for cash withdrawals from foreign networks: 4.00% (minimum of €3.50)

(5) Temporary renewable annual, multi-year or single-premium insurance taken out with Unicorp Vida (accident or life-risk insurance), Caser (car, health, dental, multi-risk home, payment protection, pet, hunting, comprehensive rental, funeral or accident insurance), Santa Lucía (funeral insurance) and/or Unión Duero Vida (life-risk insurance) mediated through Unicaja Mediación, S.L.U., a related banking-insurance operator, duly registered at the Special Administrative Registry of Insurance Brokers kept by the Directorate-General of Insurance and Pension Funds (Registration No. OV-0010), acting through the Unicaja Banco, S.A. network. Third-party liability insurance taken out according to prevailing legislation. You can query the insurance companies Unicaja Mediación, S.L.U. has entered into agency agreements with at www.unicajabanco.es/seguros. The insurance policies' coverage is subject to the General and Specific Terms and Conditions of the policies taken out.

(6) Credit meant for consumers who are natural persons solely for the payment of their insurance premiums. Terms and conditions valid until January 31, 2027. Nominal annual interest rate: 0.00%. AER: 0.000%. Based on a typical example of a Uni Insurance Plan credit of €1,500.00 granted, the total amount of which has been drawn down as of the first day the contract is in force with a regular fixed monthly repayment method over twelve months, in which the customer would pay twelve monthly instalments of €125.00, the total amount owed being €1,500.00. The existence of further drawdowns from the Uni Insurance Plan credit in this period or payment incidents are not envisaged in this example. Multi-year or single premium policies can be financed for 12 months or up to the single-premium period for at most 36 months.

(7) The authorised overdraft will be granted where there have been salary payments meeting the required amount over the course of three consecutive months.

(8) Granting subject to the institution's criteria.

Online subscription terms and conditions

You can get in touch with us on the following numbers to correct any mistakes made when entering the data during the process: 900 15 15 16 or 952 60 67 67.

Once the contract has been entered into, the documents will be stored in our systems. You can exercise your rights of access, rectification, elimination, objection, restriction to processing and portability, as well as not to be subject to automated decision-making and profiling, by sending written notice thereof to the Unicaja Customer Service Office, which is located at Avenida de Andalucía, 10-12, Malaga (Post Code: 29007), or by sending an e-mail to atencion.al.cliente@unicaja.es.

The contract will be entered into in Spanish.

The contract must be signed on the same day as we place it at your disposal on the signature platform, otherwise the subscription process will expire.