AER (Annual Equivalent Rate), total cost of the mortgage loan and full amount owed by the mortgagee based on a typical example of a loan amounting to €150,000.00 having a front-end fee of 0.15% and a repayment term of 25 years through the payment of 300 constant monthly principal and interest repayments at the interest rate indicated below:

25-YEAR FIXED-RATE MORTGAGE

(1) Meeting all the requirements to obtain the maximum interest rate bonus:

AER with maximum bonus: 3.99 % (3) For salaries as from € 2,000.

- Annual percentage rate (APR): Fixed rate in the first six months: 3.05 %. Fixed rate subsequently: 3.00 %. This APR may be obtained with other combinations of subscribed products/services other than those used by Unicaja to calculate the example.

- No. of monthly repayments: 300. Date the first monthly repayment is due: 05/02/2026. First six months repayment: € 715.38. Subsequently: € 711.54. Except the last repayment of € 709.58.

- Total amount owed: € 234,809.83. Total interest: € 63,483.08. Total cost of mortgage loan: € 84,809.83.

Example of products, selected by Unicaja, which can be jointly subscribed to obtain the bonified interest rate (APR) that has been used to calculate the AER with the maximum bonus: Salary of at least €2,000 net per month directly deposited into account. Credit card consumption of at least €600.00, calculated in the 6 months prior to each half-yearly review date of the interest rate subsidies. Protection Home Insurance. 100% Risk Life Insurance associated to the loan. Minimum contribution to a Pension Plan of 0.6% of the capital outstanding in the 6 months prior to each half-yearly interest rate subsidy review date.

The fulfilment of requirements will be checked as of the second half-year of the loan's and thereafter at successive six-monthly reviews.

- Annual expenses charged to the customer in the example used while meeting all the requirements: Protection Home Insurance (4): €267.65. Life Insurance (4): €358.51. Contribution of 0.6%, biannual, of the outstanding principal to a pension plan having an annual management and depositary fee of €34.68. Credit card maintenance fee: €48.35. Demand account maintenance fee: €120.00 per year. Valuation: €372.00. Opening commission: €225 (these last two expenses paid at the time the mortgage is taken out).

AER with maximum bonus: 4.19 % (3) for other income.

- Annual percentage rate (APR): Fixed rate in the first six months: 3.25 %. Fixed rate subsequently: 3.20 %. This APR may be obtained with other combinations of subscribed products/services other than those used by Unicaja to calculate the example.

- No. of monthly repayments: 300. Date the first monthly repayment is due: 05/02/2026. First semester repayment: € 731.14. Subsequently: € 727.25. Except the last repayment of € 726.77.

- Total amount owed: € 239,524.61. Total interest: € 68,197.86. Total cost of mortgage loan: € 89,524.61.

Example of products, selected by Unicaja, which can be jointly subscribed to obtain the bonified interest rate (APR) that has been used to calculate the AER with the maximum bonus: Salary deposited directly into account as from €600 and below €2,000 per month. Credit card consumption of at least €600.00, calculated in the 6 months prior to each half-yearly review date of the interest rate subsidies. Protection Home Insurance. 100% Risk Life Insurance associated to the loan. Minimum contribution to a Pension Plan of 0.6%, of the capital outstanding in the 6 months prior to each half-yearly interest rate subsidy review date.

The fulfilment of requirements will be checked as of the second half-year of the loan's and thereafter at successive six-monthly reviews.

- Annual expenses charged to the customer in the example used while meeting all the requirements: Protection Home Insurance (4): €267.65. Life Insurance (4): €358.51. Contribution of 0.6% of the outstanding principal to a pension plan having an annual management and depositary fee of €34.68. Maintenance fee credit's card: €48.35. Demand account maintenance fee: €120.00 per year. Valuation: €372.00. Opening commission: €225 (these last two expenses paid at the time the mortgage is taken out).

(2) Without meeting requirements (interest rate without bonus):

AER without bonus: 4.13 % (3) For salaries as from € 2,000.

- Annual percentage rate (APR): Fixed rate in the first six months: 3.05 %. Fixed rate subsequently: 4.00 %.

- No. of monthly repayments: 300. Date the first monthly repayment is due: 05/02/2026. Repayment in first half-year: € 715.38. Subsequently: € 790.64. Except the last repayment of € 789.69.

- Total amount owed: € 238,861.74. Total interest: € 86,739.49. Total cost of mortgage loan: € 88,861.74.

- Annual costs charged to the customer without meeting requirements: Indemnity insurance (5): € 61.01. Maintenance fee of demand account only intended for the loan's repayment: € 0.00. Valuation: € 372.00. Opening commission: € 225 (these last two expenses paid at the time the mortgage is taken out).

AER without bonus: 4.34 % (3) for other income.

- Annual percentage rate (APR): Fixed rate in the first six months: 3.25 %. Fixed rate subsequently: 4.20 %.

- No. of monthly repayments: 300. Date the first monthly repayment is due: 05/02/2026. Repayment in first half-year: € 731.14. Subsequently: € 807.31. Except the last repayment of € 807.56.

- Total amount owed: € 243,858.48. Total interest: € 91,736.23. Total cost of mortgage loan: € 93,858.48.

- Annual costs charged to the customer without meeting requirements: Indemnity insurance(5): €61.01. Maintenance fee of demand account only intended for the loan's repayment: €0.00. Valuation: €372.00. Opening commission: €225 (these last two expenses paid at the time the mortgage is taken out).

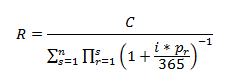

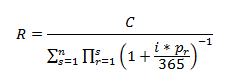

The French amortization method has been used to calculate the capital instalments , an amortization system in constant instalments in which a larger amount of interest than capital is early in the first years and in the last years more capital than interest is paid. The formula to calculate the amount of the instalments is as follows:

The values the formula uses have the following meaning:

R: monthly instalment payable

C: nominal amount of the loan, principal (in the case of not fulfilling the requisites, it will be the capital pending repayment at each moment).

n: number of instalments. As of the interest review, they will be calculated on the part pending.

r: multiplication index (∏)

s: summation index (∑).

pr: days of interest accrual per interest liquidation period from calculation of the instalment (the values 28, 29, 30 or 31 may be taken depending on the month).

i: nominal annual interest rate applicable to the period of interest concerned, expressed as per unit.

The applicable formula to calculate the interest of this loan shall be the following: Capital pending multiplied by the N.I.R. (by per unit amounts) and time, divided by 365. In this formula, the capital is considered to be the balance of capital; the N.I.R., the annual interest rate; and the time, the number of calendar days depending on the month calculated (28, 29, 30 or 31).

The amortization of the principal shall be equal to the instalment minus the interest.

(3) The AER indicated above has been calculated on January 5, 2026 using the APR and costs set out above, which are charged to the customer, assuming that no early partial or total redemption is made throughout the loan's entire duration. Monthly principal and interest repayments.

Due to the fact that the account is subject to fixed maintenance fees and, where appropriate, the credit card, the AER may vary according to the amount and term granted. The holders' age plus the loan's term may not exceed 75 years for a main residence or 70 years for a second residence.

Amount from 50,000 euros and term from 8 years.

In the event of early repayment or redemption, either partial or full, of the loan during the first ten years of the loan agreement's term or from the day on which the fixed interest rate applies, a compensation in favour of the lender may be set, which may not exceed the amount of the financial loss the lender may suffer, with a limit of 2% of the principal repaid early. In the event of early repayment or redemption, either partial or full, of the loan from the end of the aforementioned period until the end of the loan's term, a compensation in favour of the lender has been set, which may not exceed the amount of the financial loss the lender may suffer, with a limit of 1.5% of the principal repaid early.

(4) Annual Protection Home Insurance premium calculated for an empty flat measuring 80 m2 whose structure is valued at €64,000.00. Annual premium of the life insurance associated to the loan calculated for a 30-year-old person. These insurance policies can be taken out with the insurance company chosen by the customer. Nonetheless, both kinds of insurance must be taken out with the intermediation of Unicaja to be able to take advantages of a bonified interest rate while meeting requirements. The insurance premiums will be updated annually in accordance with the specific terms and conditions of the policy.

(5) Annual premium of indemnity insurance (fire and third-party liability insurance) calculated for an empty flat of 90 m2 whose structure is valued at €72,000.00 . This insurance may be taken out with the company of your choice.

The borrower will be liable to Unicaja for the loan's repayment, not only with their home but also with all their current and future assets. You may lose your home if you fail to make your repayments promptly. Should a guarantor(s) be involved in the loan, the guarantor(s) will also be liable with all their present and future assets.