Menu

ALL PRODUCTS

OUTSTANDING EXCLUSIVE

OUTSTANDING EXCLUSIVE

LIMITED TIME OFFER

ALL YOUR PRIVILEGES

DISCOVER

FOR DAY-TO-DAY NEEDS

TO INVEST AND SAVE

MANAGE YOUR BUSINESS

FOR DAY-TO-DAY NEEDS

TO GROW

TO INVEST AND SAVE

Menu

ALL PRODUCTS

OUTSTANDING EXCLUSIVE

OUTSTANDING EXCLUSIVE

LIMITED TIME OFFER

ALL YOUR PRIVILEGES

DISCOVER

FOR DAY-TO-DAY NEEDS

TO INVEST AND SAVE

MANAGE YOUR BUSINESS

FOR DAY-TO-DAY NEEDS

TO GROW

TO INVEST AND SAVE

This number is indicative of the risk of the product, with 1/6 indicating low risk and 6/6 high risk.

Unicaja Banco, S.A. is a member of the Deposit Guarantee Fund for Credit Institutions created by Royal Decree-Law 16/2011, of 14 October, covering a maximum amount of €100,000 (or, in the case of deposits not denominated in euros, the equivalent in the relevant currency) per depositor and credit institution.

Risk score related to the account

New Remunerated Online Account

Up to an extra €600¹!

And a €100 cashback on your bills

Only for new online customers!

(1) Typical example: AER of 2.018% in the case of an average monthly balance of €30,000 at an APR of 2.00%. Gross interest amounts to €50 a month with monthly settlements. No maintenance or administration fees.

We've got the mortgage that adapts to your needs. Use our mortgage simulator and calculate your repayments with no strings attached.

In addition, your mortgage loan entitles you to a 5% discount at IKEA and free advice from an interior designer. Only until 30 September 2024.

And you are under 35 years of age, get your Youth Mortgage with up to 97.5% of the appraisal or purchase value, whichever is lower.

Granting subject to the institution's criteria.

Our loan grants you up to €60,000 to finance your new or second-hand vehicle at a fixed interest rate.

Destapamos el potencial de base que llevamos dentro

Cambiamos nuestra Identidad Corporativa.

Otro pequeño-gran paso, para que tú puedas seguir descubriendo tu propio mundo de opciones.

Any new customers who sign up for a PlayStation® Account and Debit Card online will receive a PSN credit of €25 when they spend at least €20 with their PlayStation® Card.

Get the new Real Madrid Debit Card, no fees for new online customers.

No issuance or maintenance fees for new online subscriptions until June 30, 2024.

Always close to you

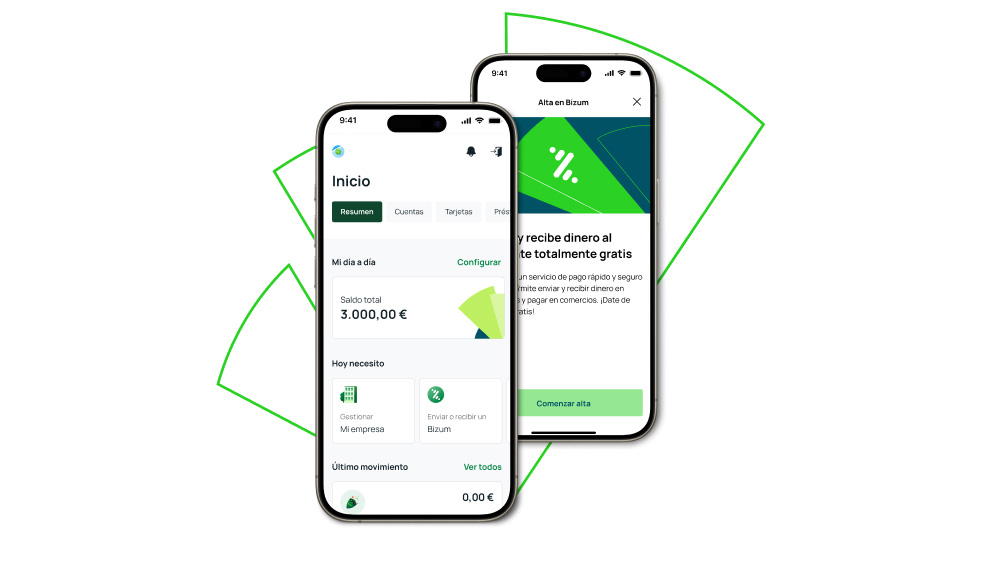

Download our Digital Banking app

Discover the Unicaja app and enjoy a quick, secure and convenient experience.

Check your accounts, make transfers and gain access to multiple services from wherever you may be!

Don't wait any longer! Download the Unicaja app now and take the bank with you anywhere.

Are you planning to go any of our branches? Request a prior appointment

Remember that you can request an appointment to avoid queues and conveniently go to any of our branches.

Customer Service Department

Unicaja places the Customer Service Department at your disposal if you wish to file a formal complaint about any of our services.

Can we help you?

Also at 952 076 263 or through the contact form.

Our telephone service hours are Monday to Saturday from 8:00 a.m. to 10:00 p.m. (except national holidays).

We also put other contact methods at your disposal: